Considering a Section 721 DST for Your 1031 Exchange

Commonly referred to as an Umbrella Partnership Real Estate Investment Trust (UPREIT) Transaction or a 721 Exchange, Section 721 of the Internal Revenue Code provides investors who are interested in selling their real estate assets an alternative strategy to defer capital gains taxes on the property sale.

When to Consider a Section 721 DST for Your 1031 Exchange

Investors who no longer wish to perform a 1031 Exchange into another like-kind property can instead utilize a 721 Exchange, allowing them to contribute their physical property directly to the operating partnership (OP) of a real estate investment trust (REIT) in exchange for operating partnership units (OP Units). Generally, these OP Units hold an equivalent value as the contributed property and have the potential to provide many of the same tax benefits as real estate ownership. After a short holding period, investors seeking additional liquidity can often convert the OP Units into common shares of the REIT through a potentially taxable transaction.

While the majority of real estate investors don’t hold the caliber of real estate that a REIT would want to acquire in an UPREIT Transaction, the Delaware Statutory Trust (DST) can offer a solution.

Formed by a third party sponsor, DSTs offer fractional interest in top-tier properties that would typically only be available to large institutional investors. Because DST interests are treated as investment property for tax purposes, the possibility of acquiring OP Units for a real estate investment may be achievable to investors indirectly through a Section 1031 Exchange into a DST.

A 721 Transaction can be used in conjunction with public, private, or publicly registered non-traded REITs, all of which have unique investment characteristics to consider. Legacy can help you determine what option best meets your investment goals and needs.

A 721 Transaction is completed when an individual contributes an investment property to the operating partnership of a REIT. Instead of receiving cash for the sale of the property, the investor receives OP Units of the operating partnership in the UPREIT structure.

Section 721 Roll Up Structures

A growing number of DST offerings allow sponsors to exercise an option to acquire the beneficial interest held by investors after a specified period of time. There are two basic structures that these transactions utilize for a tax-free acquisition under Section 721:

Optional Roll Up Structure: Provides investors with the option to roll up to a REIT or receive their proceeds in the form of cash.

Forced Roll Up Structure: Allows the operating partnership to determine whether the investor will be forced to roll up to a REIT or receive their proceeds in the form of cash. Investors who are comfortable with a REIT or partnership and are looking to diversify their holdings typically utilize the forced roll up structure.

When choosing between a forced roll up structure or optional roll up structure, there are important details investors should consider. In either structure, cash proceeds may or may not be eligible for subsequent 1031 Exchange tax deferral treatment. Once investors have acquired their beneficial interests in the DST, there is typically a holding period of two years before the operating partnership can exercise the option to begin acquiring the beneficial interest from the investors. This limitation exists to help protect investors from potentially losing their tax-deferred Section 1031 Exchange treatment on the initial acquisition of the DST interest.

At Legacy, we offer both structure types and will work with you to build an investment strategy tailored to your unique goals, needs, skill level, and finances.

It’s important for investors to understand the appraisal process and how the properties will be valued at the time of exercise of the option. Some of the options provide that the property will be appraised based on the value of the property subject to the existing leases, while other options provide that the property will be appraised based on the property subject to the master lease. These two options can provide different property valuations at the time of rollup. Legacy typically has both types available to discuss with 1031 Exchange clients.

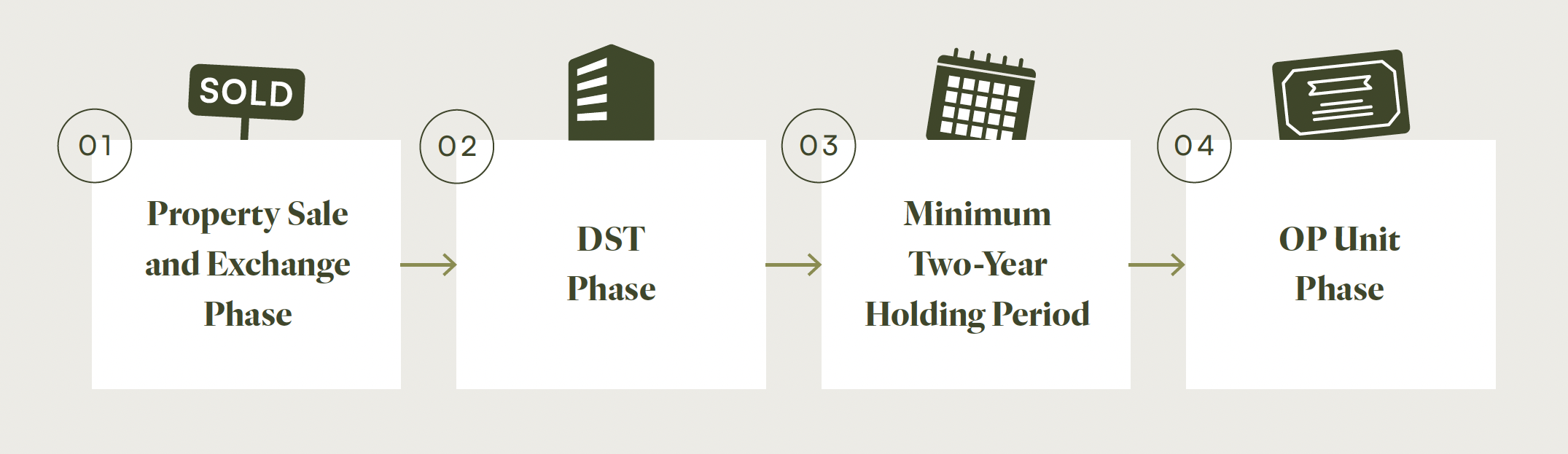

How it Works: The Process of Utilizing a Section 721 Exchange in a DST/UPREIT Transaction

#1: Property Sale & Exchange Phase

The real estate investor works with a realtor to list their investment property for sale and opens a 1031 exchange account with a qualified intermediary. Once the exchange account is opened with the intermediary, the investor can choose to use their 1031 proceeds to acquire the DST.

#2: DST Phase

Following property sale, the investor executes a tax-deferred transaction under IRC Section 1031 to acquire fractional ownership interest in a DST, which serves as replacement property within the exchange structure. Once invested in the DST, you are entitled to the income generated by the underlying DST property.

#3: Minimum Two-Year Holding Period

This limitation is included so investors won’t potentially lose their tax-deferred Section 1031 exchange treatment on their initial acquisition of the DST interest.

#4: OP Unit Phase

The investor executes a tax-deferred transaction under IRC section 721 in which their DST interests are contributed to a REIT in exchange for OP Units.

This final phase is mostly facilitated by the sponsor, but investors will typically have required documentation to complete. Legacy helps streamline this process by ensuring all reporting forms are completed and all required documentation is submitted.

Potential Benefits of a 721 UPREIT

Tax Efficiency

Both DST and UPREIT structures have the potential to provide investors with many of the same tax benefits as direct real estate ownership, including expense deductions and depreciation.

Tax Deferral

By contributing their real estate assets into a UPREIT, investors can defer the capital gains taxes that would typically be triggered by a real estate transaction until the OP Units are sold or converted into REIT Common Shares. Taxes may be deferred indefinitely, and potentially eliminated altogether.

Income Potential

REITs typically pay cash distributions to their shareholders, a portion of which may also be tax deferred. Investors have the potential to receive distributions generated by the DST prior to the 721 Transaction. After the transaction, investors have the potential to receive distributions generated by the OP Units.

Diversification

Converting to a UPREIT structure can provide access to institutional-quality properties, which may not be readily available to individual property owners. This allows investors to diversify their portfolio and help mitigate risk by gaining exposure to a broader range of institutional-quality real estate assets held within the UPREIT structure.

Liquidity

UPREIT units may have redemption provisions, or liquidity opportunities, providing investors with the ability to convert their ownership interests into cash more easily compared to DST interests or the direct ownership of real estate.

Estate Planning

For individuals looking to pass on their real estate assets to heirs and/or beneficiaries, UPREIT units may offer more flexibility and efficiency in estate planning compared to transferring individual properties. Pursuant to estate tax laws, heirs and/or beneficiaries may receive a stepped-up basis to current market value for taxation purposes resulting in permanent tax deferral of capital gains and depreciation recapture.

Professional Management

DSTs and UPREITs are both structured as passive real estate investments. A professional management team oversees the real estate property or portfolio of assets, removing the burden of active property management for individual investors.

Potential Limitations of a 721 UPREIT

The greatest limitation to the 721 UpREIT approach is that it eliminates the ability to perform another 1031 exchange OUT of the REIT.

Investors should recognize that they typically will not have investment decision rights in the DST, the operating partnership, or the REIT aside from determining when to exercise liquidity in the REIT. However, redemption requests are subject to the availability determined by the OP–there is no guarantee that redemption requests to liquidate units will be granted.

The 1031 Exchange and 721 Transaction each provide investors with the opportunity to exit out of existing real estate investments and reinvest without tax consequences. The 721 Transaction can be an alternative or complementary solution to a traditional 1031 Exchange and tends to appeal to investors that are no longer interested in active property management.

At Legacy, we work with you to build an investment strategy tailored to your unique goals, needs, skill level, and finances. Give our knowledgeable team a call to learn more about the 721 UPREIT structure and determine which approach best aligns with the legacy you want your investments to build.

Legacy Investments & Real Estate is your partner in passive real estate.

We are passionate in our pursuit to help every investor build their financial legacy by unlocking the power of passive real estate. Through custom strategies aligned to their unique goals and needs, we provide investors with the potential for all the benefits of real estate investing without the headaches of property management.

Ready for professional, tailored guidance on your passive real estate investment needs?

Other resources you might find helpful

Because investor situations and objectives vary this information is not intended to indicate suitability or a recommendation for any individual investor.

This is for informational purposes only, does not constitute individual investment advice, and should not be relied upon as tax or legal advice. Please consult the appropriate professional regarding your individual circumstance.

Potential cash flows/returns/appreciation are not guaranteed and could be lower than anticipated.

Diversification does not guarantee a profit or protect against a loss in a declining market. It is a method used to help manage investment risk.

There are material risks associated with investing in DST properties and real estate securities including liquidity, tenant vacancies, general market conditions and competition, lack of operating history, interest rate risks, the risk of new supply coming to market and softening rental rates, general risks of owning/operating commercial and multifamily properties, short term leases associated with multi-family properties, financing risks, potential adverse tax consequences, general economic risks, development risks, long hold periods, and potential loss of the entire investment principal.

DST 1031 properties are only available to accredited investors (typically defined as having a $1 million net worth excluding primary residence or $200,000 income individually/$300,000 jointly of the last two years; or have an active Series 7, Series 82, or Series 65). Individuals holding a Series 66 do not fall under this definition) and accredited entities only. If you are unsure if you are an accredited investor and/or an accredited entity, please verify with your CPA and Attorney.

IRC Section 1031, IRC Section 1033 and IRC Section 721 are complex tax concepts; therefore, you should consult your legal or tax professional regarding the specifics of your individual situation.