Possible DST Exit Outcomes

Considering the Various Delaware Statutory Trust (DST) exit scenarios is crucial for ensuring the investment aligns with long-term financial goals and liquidity needs.

For federal income purposes, the Delaware Statutory Trust is classified as a grantor trust, where the investors are the beneficiaries and the sponsor is the grantor. As a result, investors in the DST own a direct interest in the real property in proportion to their investment percentage, but have no say in the ongoing management or eventual sale of the property. The private placement memorandum (PPM) will outline the disposition strategy and timeline, but the decision to sell is ultimately determined by the sponsor, based on market conditions and other variables.

Investors will be notified prior to the sale and will receive their proportional share of the sales proceeds including any gains from potential appreciation. However, there are several possible exit scenarios that DST investors need to understand. By evaluating these options early on, investors can anticipate potential challenges and make informed decisions about when and how they can expect to exit their investment.

DST Exit Outcome #1

Portfolio Liquidation (No UPREIT)

Under IRS Revenue Ruling 2004-86, a DST property qualifies as “like-kind” real estate on both sides of a §1031 exchange-buying AND selling. Upon the sale of a DST property or portfolio, investors have the same three options as available with any rental property sale.

Considerations:

DST investors should expect a hold period of 7-10 years before the property is sold.

Like any §1031 Exchange, upon sale it is possible to keep some “boot”, and pay tax only on funds received in the transaction.

Some DSTs may be unable to sell ALL of the properties in their portfolio in a single transaction. Separate sales of DST properties may trigger multiple, separate §1031 Exchanges for investors.

To complete a fully tax-deferred exchange without requiring additional cash from outside escrow, DST owners will need to invest in a property whose leverage ratio is at least as high as the relinquished DST property.

If a DST with debt fails to sell its property before the loan term expires (almost always 10 years), a refinancing will violate IRS rules for 1031 DSTs and trigger a “springing LLC”. Conversion of the DST to an LLC likely would produce negative tax consequences.

EXIT OUTCOME #2

Very Limited Resale Opportunity

DST interests are illiquid securities, and investors should not subscribe if they anticipate needing access to their invested capital in less than 10 years.

Considerations:

Once closed, the offering phase for a DST cannot be reopened, and no additional capital can be requested from investors.

There is no secondary market for DST interests.

SEC regulations restrict the resale of private placement securities, particularly in the first year after investment.

It is possible for other investors in the same DST to acquire another owner’s shares, but such infrequent transactions typically involve a significant discount to then-current asset value.

Sale of DST interests in the absence of a §1031 Exchange will trigger capital-gains taxes.

EXIT OUTCOME #3

UPREIT* Conversion and/or Fair Market Value (“FMV”) Option

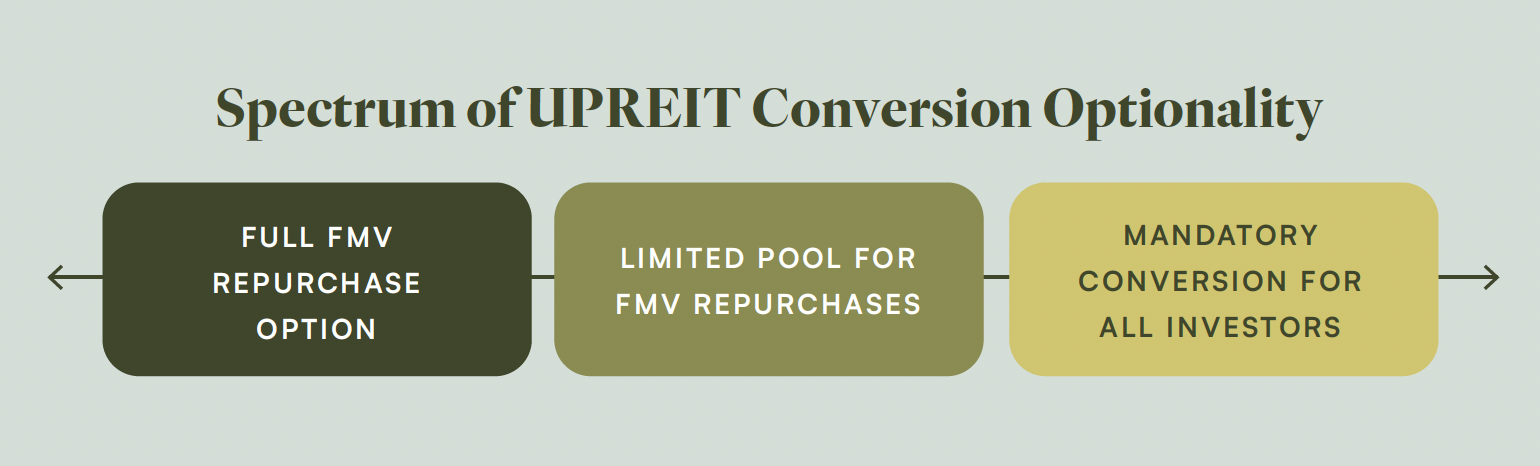

All DST trustees have discretion and authority to transfer a DST property to a REIT in exchange for operating partnership units. For some DST programs, this is the anticipated outcome from the outset. For other DSTs, the UPREIT strategy may be a remote possibility. There is no guarantee that a DST will or will not conduct an UPREIT conversion transaction.

*UPREIT stands for “Umbrella Partnership” Real Estate Investment Trust

An “FMV option” allows a DST investor to sell some or all of her DST interests to the REIT in lieu of receiving OP units, based on an estimated FMV of the property. The FMV of a DST property only two years after investment likely will NOT be greater than the original offering price.

UPREIT Conversion Phase 1: 1031 Exchange into a DST

Investor sells a rental property and exchanges it for interests in a 1031 DST.

The 1031 DST sponsor is affiliated with a public REIT; property often is already part of the REIT portfolio.

The investment period in the 1031 DST is typically two years.

Some programs have an optional §721 transfer into an UPREIT; others are mandatory.

UPREIT Conversion Phase 2: §721 Transfer DST Interests for UPREIT Operating Partnership

Under §721, DST shares are exchanged for units in the operating partnership (“OP”) of the REIT.

Transfer is designed to defer capital gains taxes, similar to a §1031 exchange.

Investor may be required to execute a debt guaranty agreement to avoid recognized gain.

OP distributions mirror REIT distributions; investor receives a Schedule K-1. Investors may be required to file returns in multiple states.

Some time after the UPREIT conversion, it may be possible to redeem/sell an amount equal or less than the cost basis without federal tax consequences-consult with a tax professional.

Investor may hold OP units indefinitely.

UPREIT Conversion Phase 3: §721 Transfer DST Interests for UPREIT Operating Partnership

Subject to any applicable holding periods, when investor is ready to liquidate, OP units are either redeemed directly or OP units are converted to REIT shares.

This is a taxable event.

Depending on the REIT, shares may be redeemed by the REIT or sold on an exchange.

Alternatively, investors may hold their OP units until death and benefit from a step-up in basis.

Considerations:

UPREITs may impose one or more of the following fees on DST investors:

Conversion fee

Ongoing asset management fees

Liquidation fee

Legacy is your partner in passive real estate. Armed with a deep understanding of individual goals and needs, we help our clients navigate these DST exit scenarios, providing guidance on the best course of action in line with any long-term plans.

Legacy Investments & Real Estate is your partner in passive real estate.

We are passionate in our pursuit to help every investor build their financial legacy by unlocking the power of passive real estate. Through custom strategies aligned to their unique goals and needs, we provide investors with the potential for all the benefits of real estate investing without the headaches of property management.

Ready for professional, tailored guidance on your passive real estate investment needs?

Other resources you might find helpful

Because investor situations and objectives vary this information is not intended to indicate suitability or a recommendation for any individual investor.

This is for informational purposes only, does not constitute individual investment advice, and should not be relied upon as tax or legal advice. Please consult the appropriate professional regarding your individual circumstance.

Potential cash flows/returns/appreciation are not guaranteed and could be lower than anticipated.

Diversification does not guarantee a profit or protect against a loss in a declining market. It is a method used to help manage investment risk.

There are material risks associated with investing in DST properties and real estate securities including liquidity, tenant vacancies, general market conditions and competition, lack of operating history, interest rate risks, the risk of new supply coming to market and softening rental rates, general risks of owning/operating commercial and multifamily properties, short term leases associated with multi-family properties, financing risks, potential adverse tax consequences, general economic risks, development risks, long hold periods, and potential loss of the entire investment principal.

DST 1031 properties are only available to accredited investors (typically defined as having a $1 million net worth excluding primary residence or $200,000 income individually/$300,000 jointly of the last two years; or have an active Series 7, Series 82, or Series 65). Individuals holding a Series 66 do not fall under this definition) and accredited entities only. If you are unsure if you are an accredited investor and/or an accredited entity, please verify with your CPA and Attorney.

IRC Section 1031, IRC Section 1033 and IRC Section 721 are complex tax concepts; therefore, you should consult your legal or tax professional regarding the specifics of your individual situation.